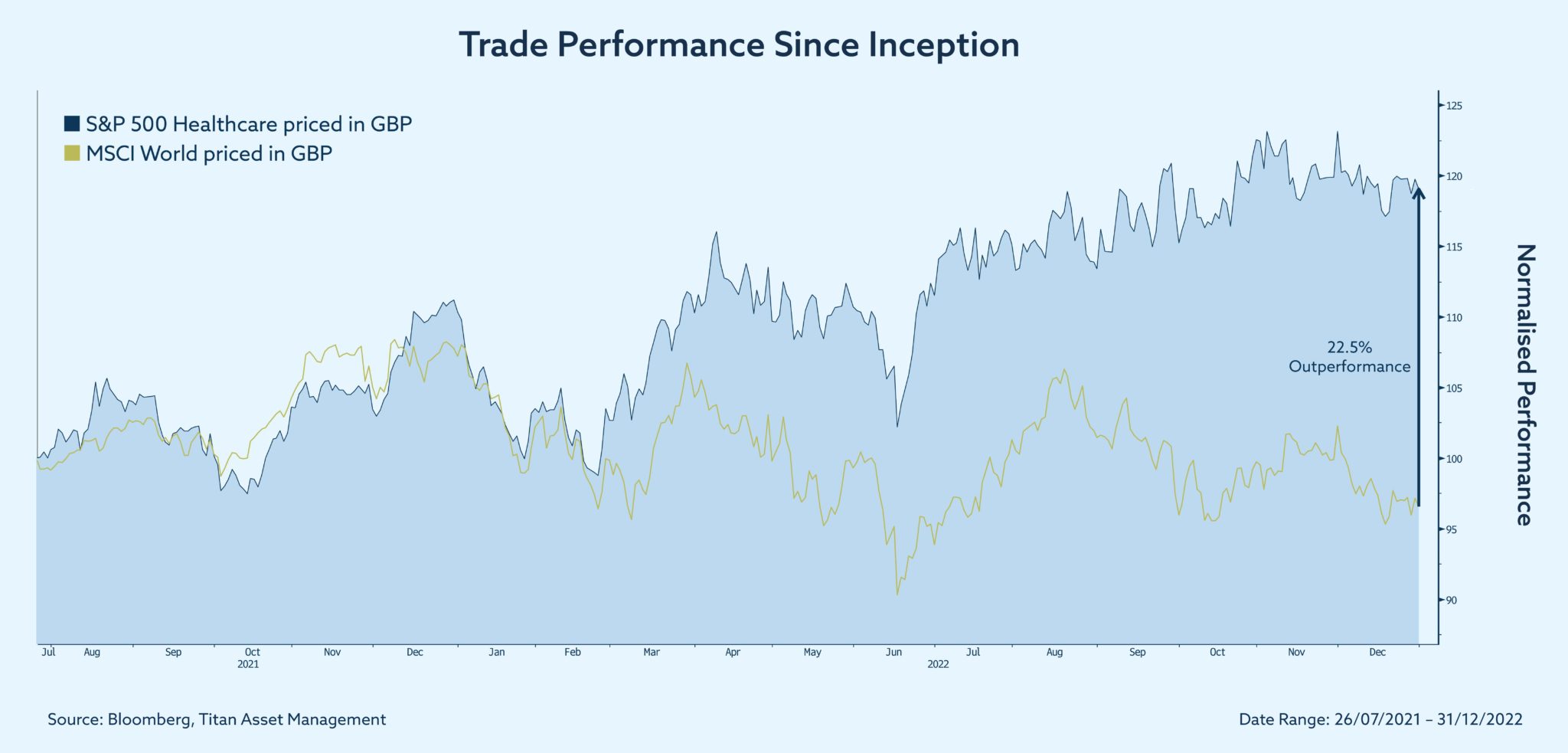

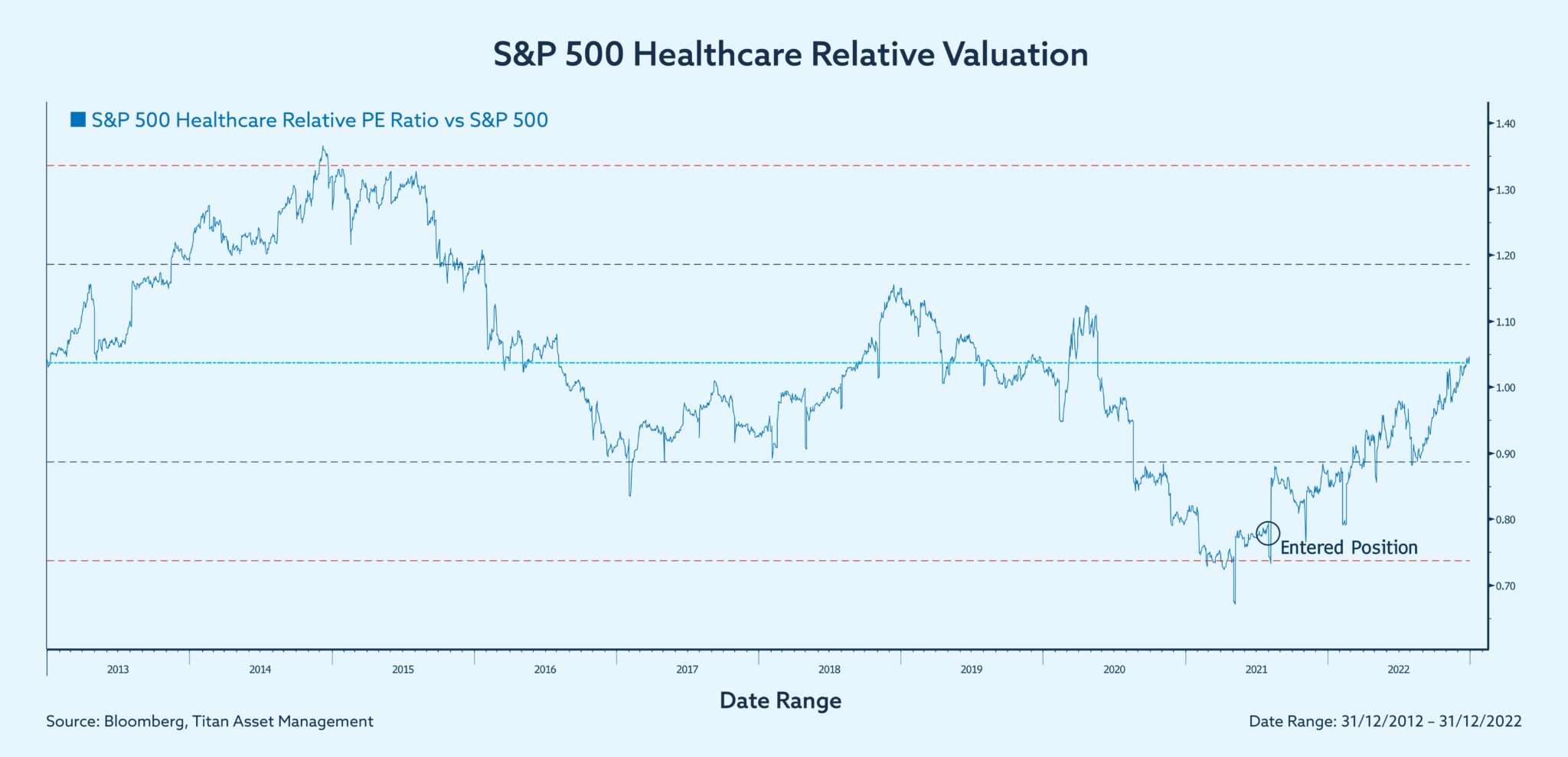

Investing in a basket of US healthcare and pharma stocks played a crucial role in providing ballast to our portfolios in what proved to be a turbulent 2022 for equity and bond markets alike. We initiated an overweight allocation to the US healthcare sector in early H2 of 2021 when the S&P 500 was at record highs, having marked its second-best H1 performance in over two decades.

With stretched equity valuations, inflation embroiling the global economy and the prospect of slowing growth, we decided to take profit on some of our more cyclical holdings and increase exposure to quality stocks trading at reasonable valuations; the US healthcare sector fit this bill. A return in demand for elective procedures, medical equipment and diagnostics following long-endured covid lockdowns was supportive for the sector.

We also saw upside from the strong drug development pipeline for a number of pharmaceutical companies.

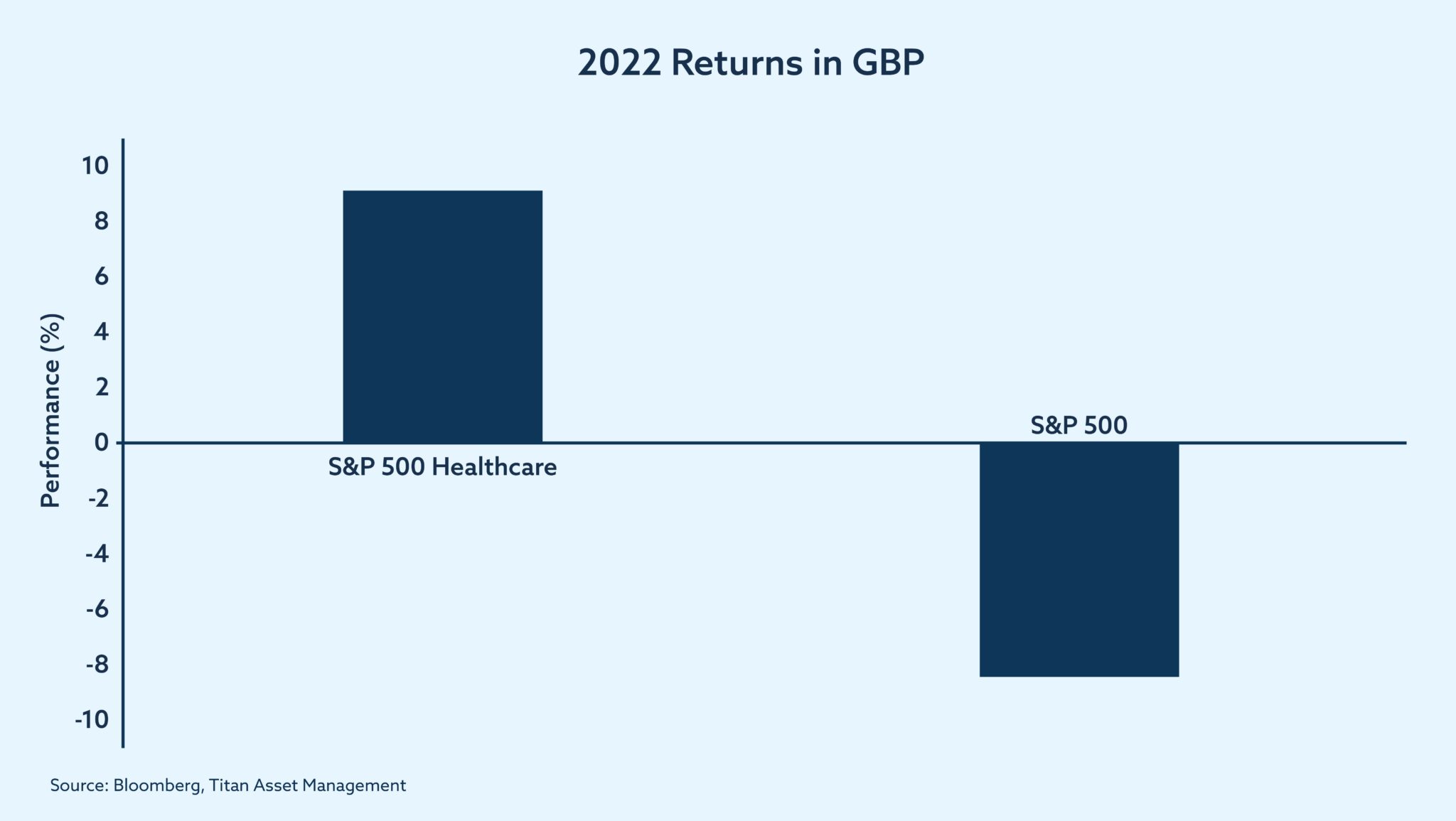

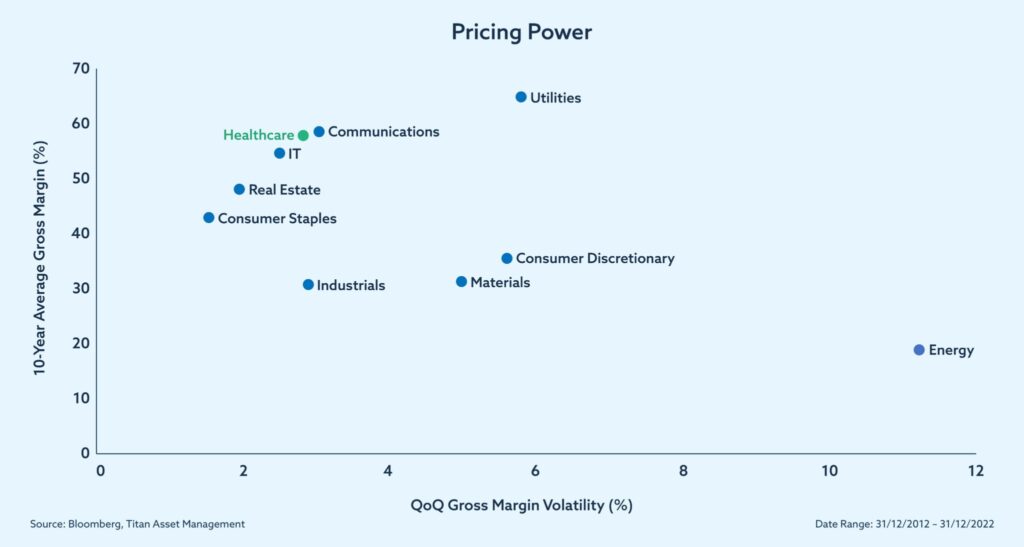

Coming into 2022, our conviction in the sector grew stronger and we increased our position. With the tragic Russia-Ukraine conflict adding to the plethora of existing supply-side pressures, the inflation narrative grew stronger and company pricing power became increasingly important. The inelastic demand for healthcare goods and services better positioned these companies to protect their margins which I referred to in a State Street and Investment Week roundtable here.

Historically, investing in large-cap healthcare has provided a defensive return profile, outperforming in the majority of market drawdowns which was in keeping with our outlook for heightened volatility. Our view that the Federal Reserve was behind the curve last year played into our preference for healthcare stocks with their robust balance sheets suiting them to higher rate environments.

While we may look to take profit on our US healthcare position as the macroeconomic backdrop evolves and new opportunities arise, we continue to like the longer-term structural tailwinds behind the sector from changing demographics to technological advancements. The World Health Organisation projects the world’s population aged 60 and over will double by 2050 and those aged 80 and over will triple, driving secular demand for a host of healthcare products and services.

This demand will be further compounded by rising real disposable income across emerging nations. Technological innovation is another key secular growth driver behind the pharma industry with R&D remaining firmly on an upward trajectory benfitting areas across medical devices, therapeutics, robotics and data-driven value-based care to name a handful.

Coming back to the macroeconomic landscape, we are cognisant of the risk-on rally in recent weeks with the market pricing in interest rate cuts later this year in the US and the prospect of a ‘soft landing’. We believe a contraction in earnings remains a downside risk to market multiples, particularly in a recessionary scenario. We therefore retain our defensive stance and overweight to US healthcare with an eye to tactically take profit when we gain greater conviction in a shift in the macro picture that could favour sustained momentum in some of 2022’s laggards.