In my January commentary, the aptly named ‘Bumpy Start’, I concluded by saying that recent events, and extreme market volatility, necessitated a ratcheting-up in investment team communication. Since then, I’ve had numerous calls with multiple advisers, the investment team has hosted several market outlook calls, all well attended, and we’ve started publishing more material which you can now access via the new Insights page on the Titan Asset Management website. The latest additions include blog posts from James Peel, ESG Portfolio Manager, and Alex Livingstone, Head of Trading and FX. We’ve also had extensive press coverage with investment team commentary appearing in The Guardian, London Evening Standard and Investment Week.

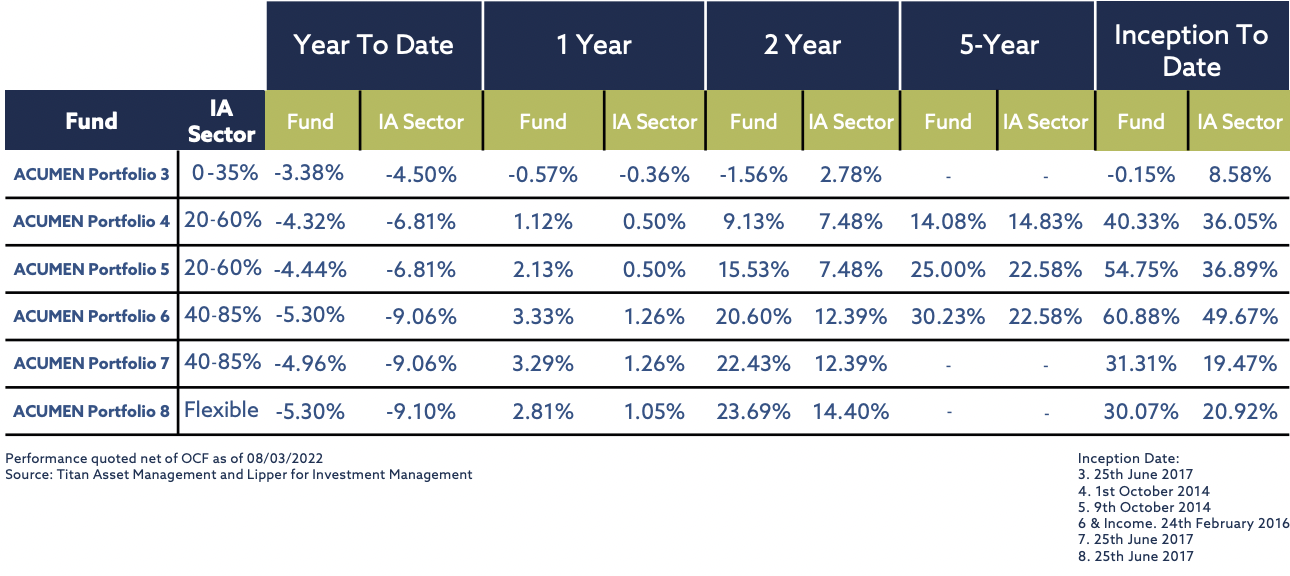

With everything that is happening in the world right now, and there’s a lot going on, I thought it would be useful to buck the trend, take a step back, and look at the bigger picture. Specifically, the evolution of our investment management process and an update on performance. As you can see in the table below, on an absolute basis the ACUMEN Portfolios have fallen in value since the start of the year. This is unsurprising given recent market headwinds. However, on a relative basis the funds have held up remarkably well, particularly versus the IA sector peer group. On a longer-term basis, the funds are performing exceptionally well too, as evidenced by ACUMEN Portfolio 8 which is outperforming the IA sector by approximately 10% inception-to-date.

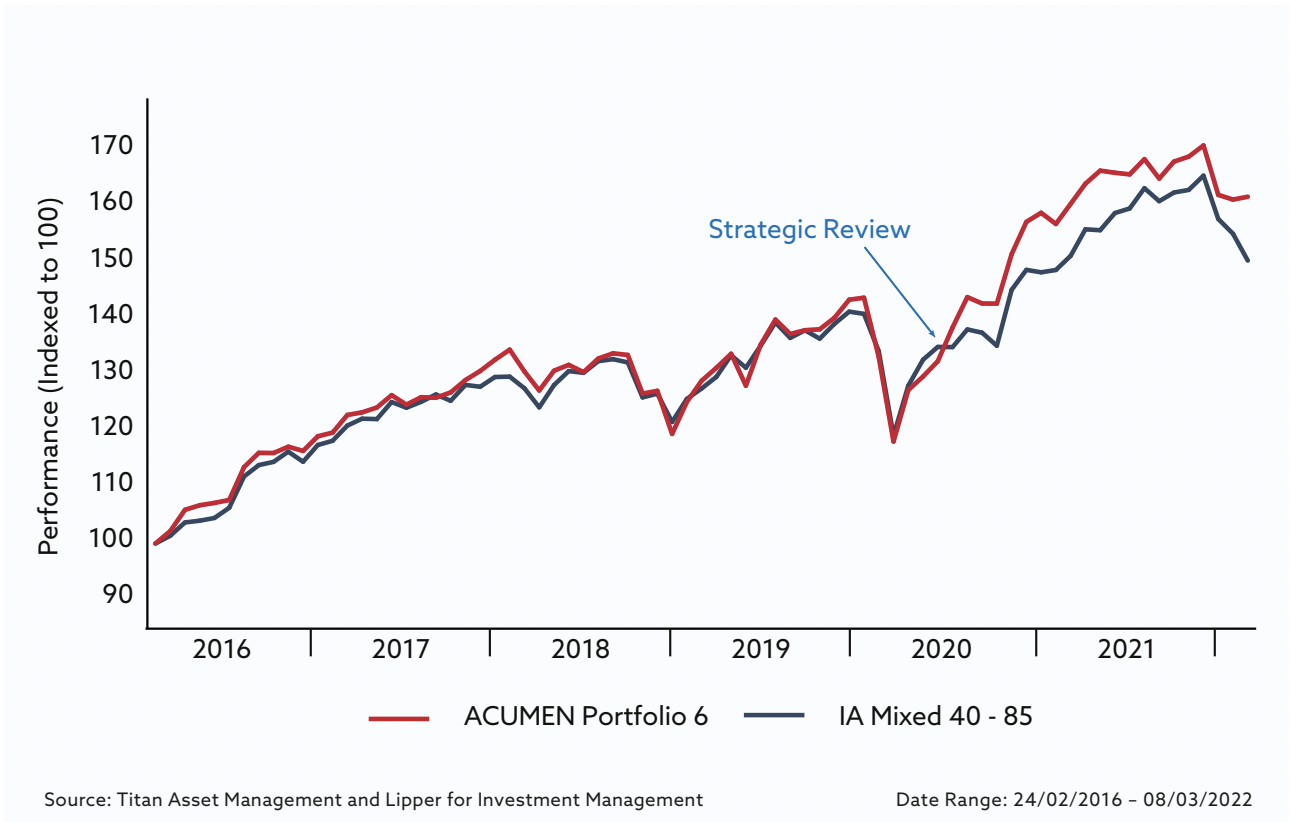

There are a variety of reasons for strong relative performance. Specifically, our active currency management strategy, commodity carve-out, revamped equity exposure, ESG focus and short-duration fixed income bias. Each of these topics will be covered by the asset class specialists within the team, starting with Alex’s latest blog the ‘Importance of Foreign Exchange’. But what I want to focus on here is the common thread binding these themes, which find their origin back in June 2020 with our strategic review. At that time, we conducted a strategic review of the funds to build-upon the team’s already strong track record. Without changing our fundamental approach to investment management, the review culminated in a number of adjustments designed to enhance our overall process.

These include introducing technical analysis to our fundamental basis, reducing the overall number of positions in each fund by half, adjusting our currency overlay strategy and shifting towards a new strategic asset allocation better aligned with the nuances of the UK investment retail space.

In my opinion, these strategic changes have contributed to a considerable improvement in investment performance. The chart below demonstrates this narrative particularly well. It shows the performance of ACUMEN Portfolio 6, which is our largest fund by AUM. Whilst performance closely mirrored the IA Sector up until June 2020, you can see that from that point forwards, subsequent performance has been noticeably differentiated. I attribute this positive development to the hard work, experience and dedication of the investment team.