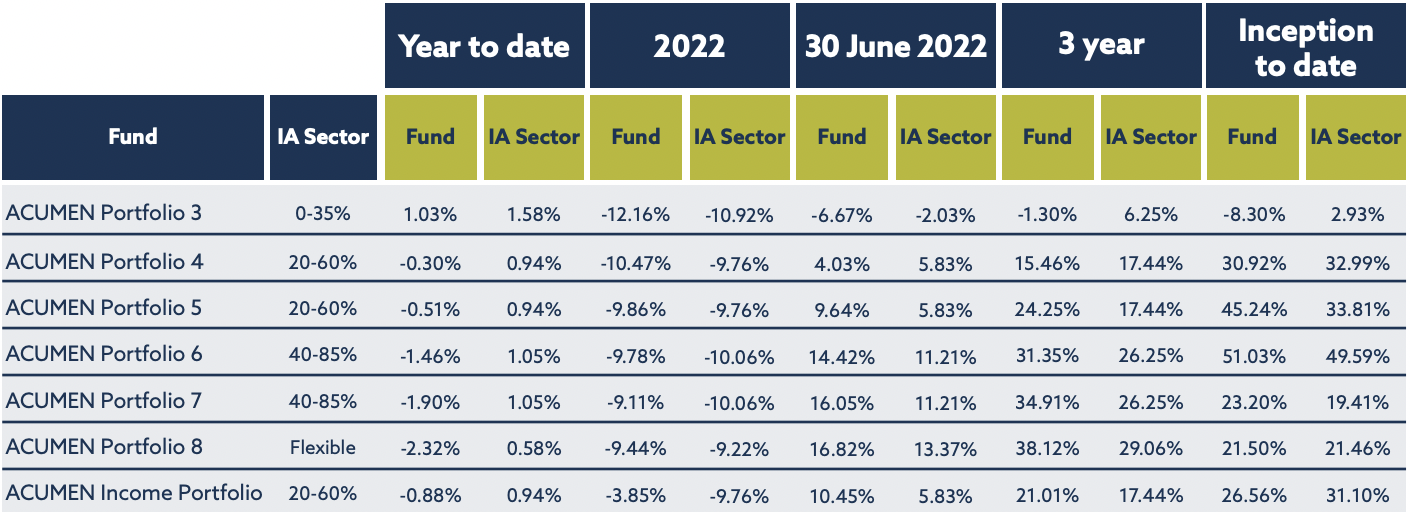

Performance Review

So far this year, the ACUMEN Portfolios have lagged the IA sector benchmark. This is due to our defensive positioning over a period where risk assets have performed well. Over the course of 2022, the funds fell in value, which is unsurprising given recent developments, performing broadly in-line with the benchmark.

Since the strategic review on the 30th June 2020, and on a longer-term basis (rolling 3-year and since inception), the ACUMEN range has held up well. With the exception of ACUMEN Portfolio 3 the funds have delivered strong absolute returns, largely outperforming the IA sector benchmark.

Key Themes

2022 was a particularly challenging year given the spike in inflation and higher rates that impacted both bond and equity markets in unison. Since Q4 last year we have seen a slight rebound in risk sentiment which took place against a very pessimistic backdrop for the global economy. The key factors driving this improvement include a reopening Chinese economy, falling energy prices, improved liquidity (courtesy of the Chinese and Japanese central banks) and a weakening US dollar.

Whilst this is a clear positive, we believe that many of these tailwinds are likely to drop away, or weaken, moving forward. The significant tightening in monetary policy over the last year leaves risk assets vulnerable to the downside which means we likely remain in a bear market rally.

The first thing to say is just how bad can it be given the economic data has held up quite well? That’s true, with a clear pick-up in US activity, for example, since the start of the year. Specifics include the bumper non-farm payroll surprise, with more than half a million new jobs added in January (and better than expected numbers in February), alongside a clear rebound in retail sales and personal consumption expenditures.

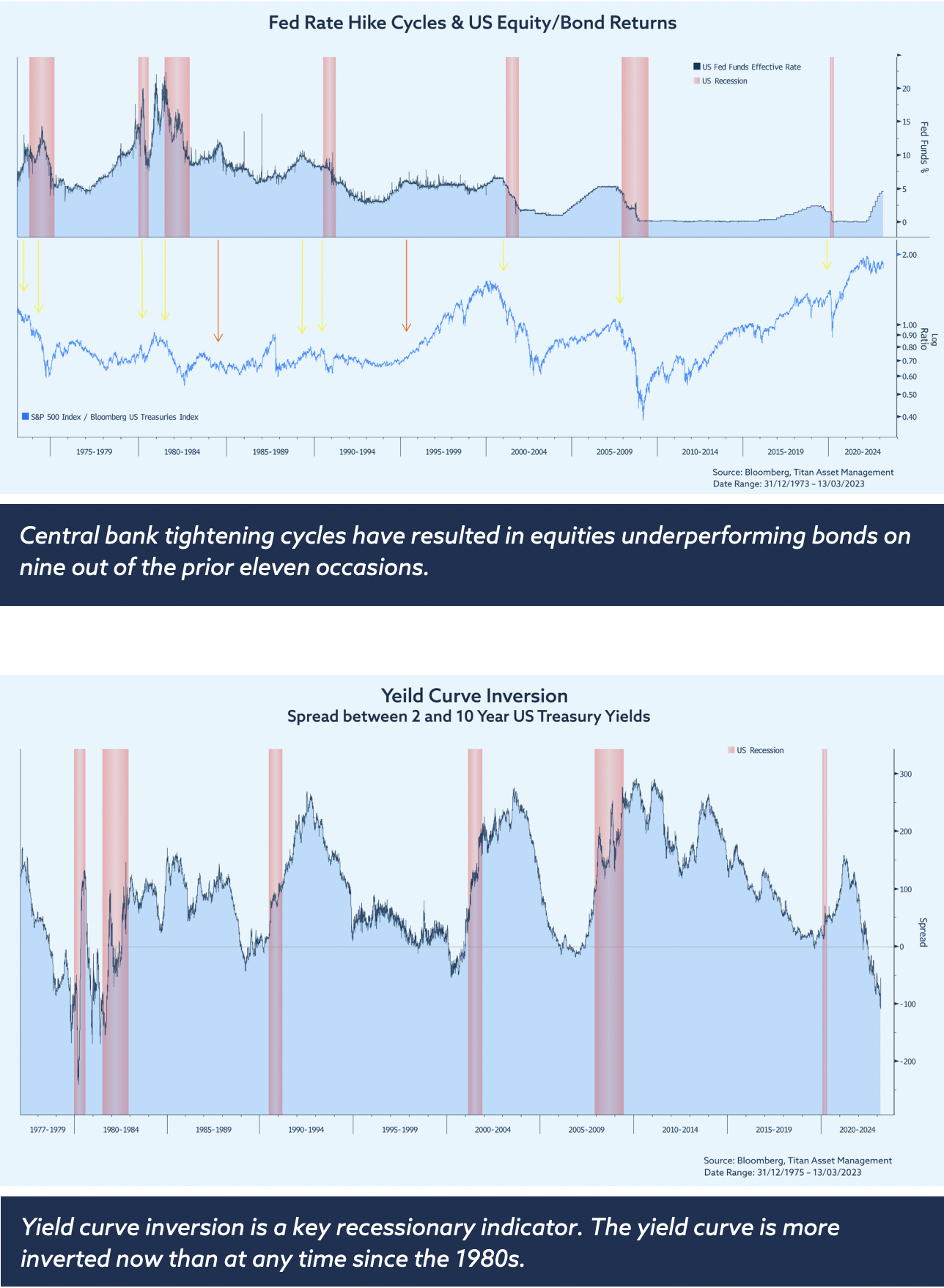

The issue is that good-news-is-now-bad-news for the economy and markets. With the economy running hotter than the Fed would like, inflation remains a problem. Earlier last month during his semi-annual testimony, Jerome Powell communicated that interest rates are ‘likely to be higher’ than previously anticipated, and they’ve already come a long way. It seems one policy error (excessive monetary loosening) is now being followed by excessive tightening. We are yet to feel the full shock of the near vertical increase in interest rates over the last year and higher-for-longer is in itself a form of tightening. History tells us that this typically leads to recession.

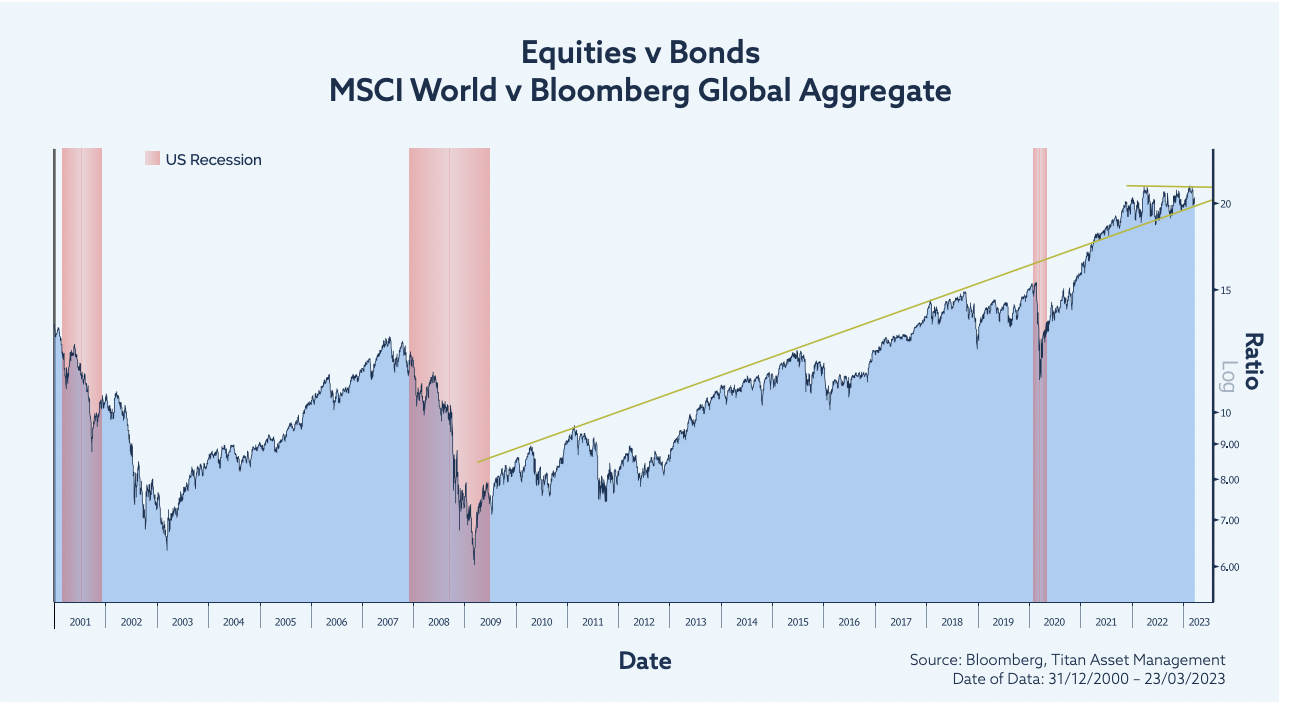

Despite the recent enthusiasm around resilient equity and credit markets, resulting in a plethora of soft or no-landing calls, it is extremely difficult to engineer a soft landing. This is shown by the red bars in the top panel of the below chart.

In most cases US equities have gone on to underperform bonds, as shown by the blue line in the bottom panel of the same chart. To add some narrative, one pre-Covid historical example includes Alan Greenspan hiking rates from June 1999 to May 2000. Whilst equities almost reached a record high in September 2000, it wasn’t until the Fed started cutting rates in January 2001, alongside the onset of recession, that equity markets sold off.

Another example is when Greenspan started hiking rates in June 2004, taking the Fed Funds rate to 5.25% in June 2006. Given the more measured pace, the market continued to rally until October 2007 before finally falling over, just as the Fed started cutting interest rates, and before the start of an official recession. The subsequent bear market lasted until March 2009, 3 months after the last rate cut and 3 months before recession officially ended.

We think this is all to come but this is primarily a process, rather than an event, as households and businesses are impacted at different times as debt becomes due, and economic decisions are reset and made anew. I’m talking about houses that are not bought because of affordability, rents dropped or not taken-up for the same reason (hotel of mum and dad), declining discretionary spending due to extortionate interest on unpaid credit balances and car lease payments, VC investments put on hold due to declining expected profitability… and so on.

Speaking of VC investments, we say ‘primarily’, because an event of some description is also very possible. Silicon Valley Bank is a case in point. Yes, there are rules to mitigate these risks, and yes Silicon Valley Bank and other ‘smaller’ banks were excused due to US specific lobbying, but ultimately this points to underlying fragility and there is real concern about these fears spreading to other regional banks. Banks, which are losing deposits to money market funds, will need to increase deposit rates to stem these flows, which will increase their cost of capital.

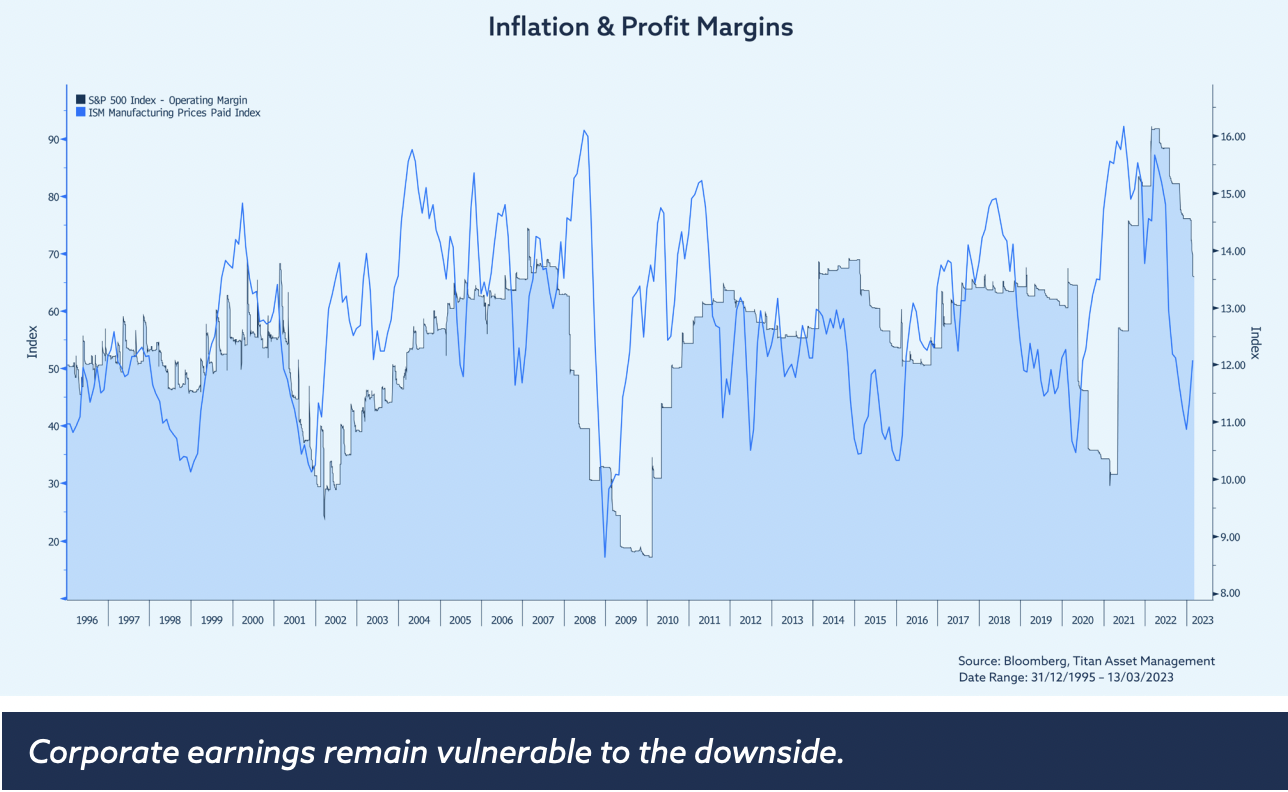

The next domino to fall is real estate, with commercial office rents also showing signs of fragility. As accidents pile-up we will see further ripple-effects across the economy as the lagged impact of prior tightening starts to show its face. Equity markets aren’t trading on earnings. The primary driver is the inflation and employment data and the expected impact on the Fed response function. But once we reach a terminal rate, earnings will eventually re-assert themselves. Corporate profit margins are deteriorating, and the impending earnings recession will hit hiring.

With US equity valuations as high as they are, should corporate earnings merely revert to the historical mean, equities can drop noticeably and just because equities are resilient right now, it doesn’t mean they will be going forward.

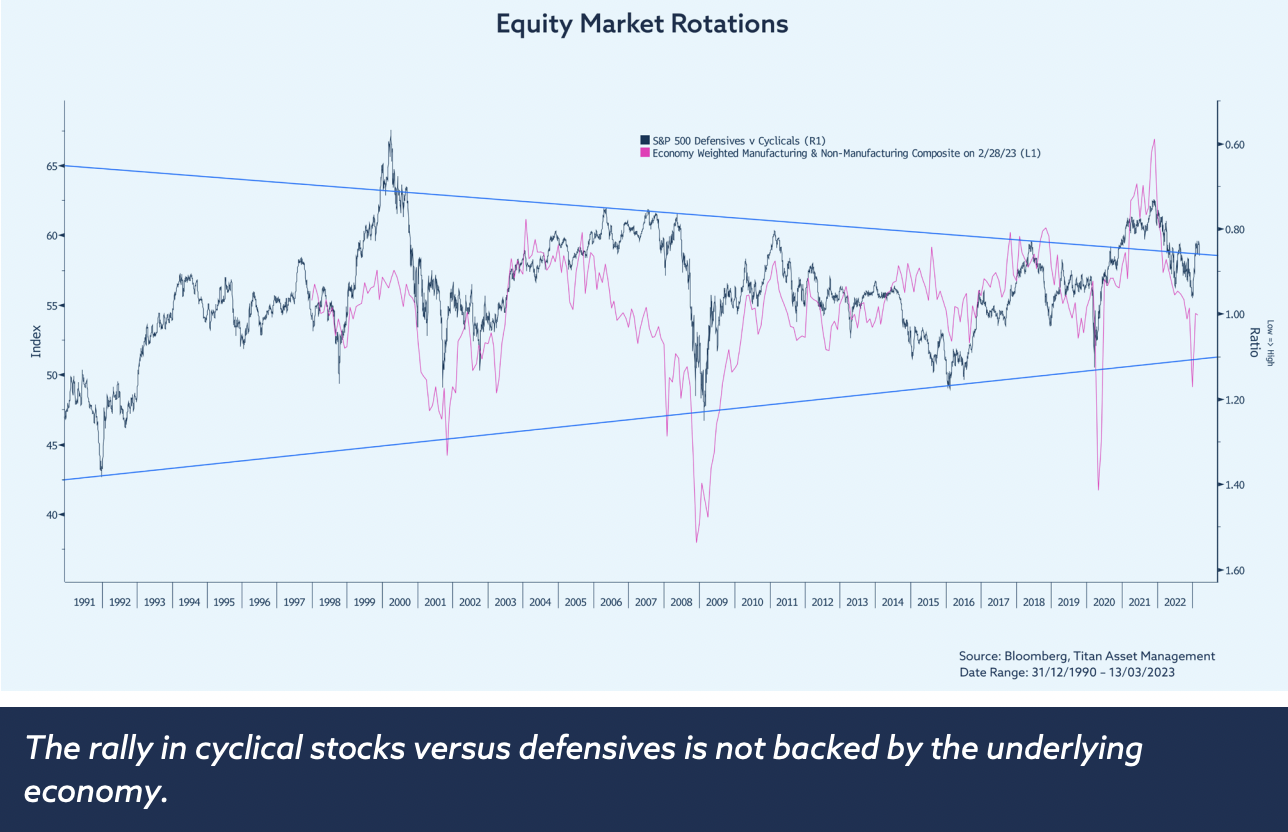

Another way to demonstrate this vulnerability is to look at the dramatic rotation, under the surface, across US equity sectors. This is demonstrated in the following chart which shows how cyclical stocks (those most geared to the economy) have outperformed defensives since the start of the year.

The recent price action is statistically significant, unwinding around half the prior full year underperformance, and not backed by the fundamentals. We see this as a key risk with 30% downside in the ratio in the scenario where the S&P 500 falls to 3,000, our bear case scenario.

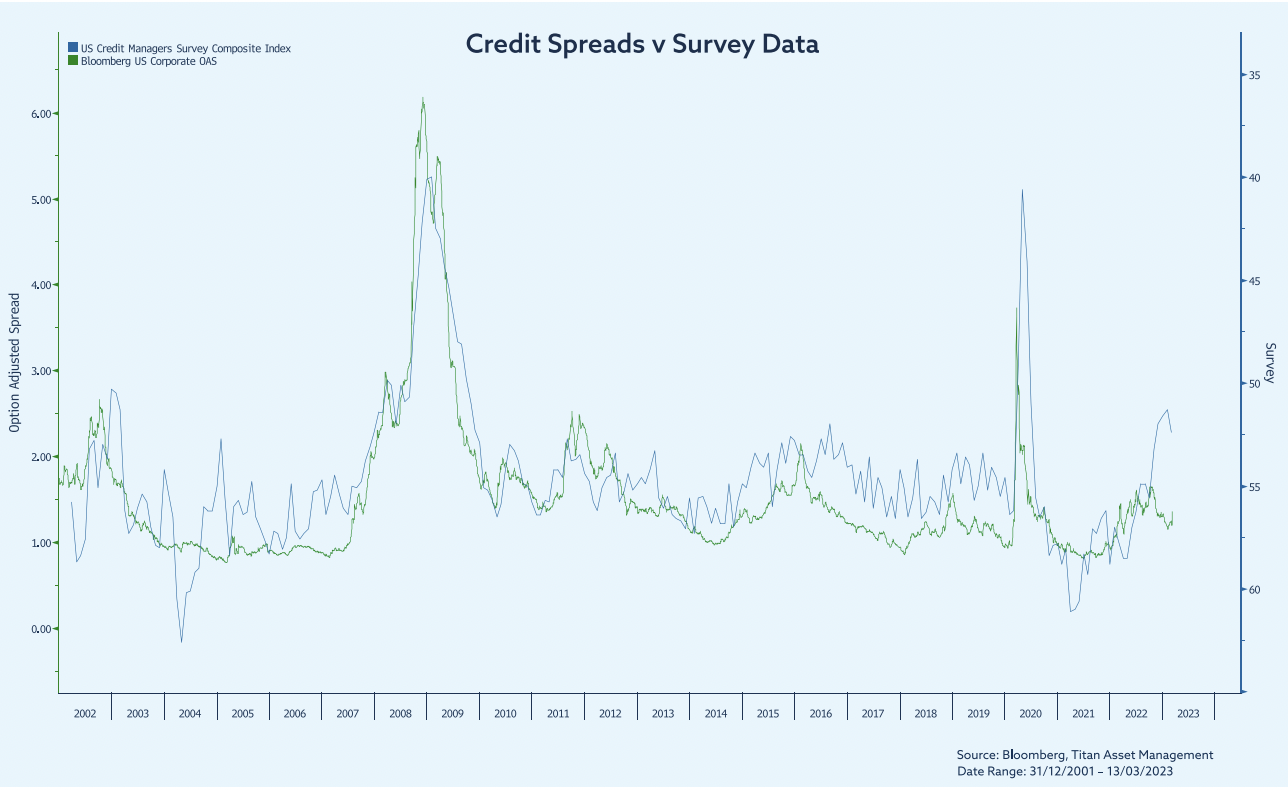

Part of the resilience in equities comes from credit markets. The disconnect is evident here as well given spreads remain tight despite the deteriorating US credit manager survey.

To summarise, we wanted to reference two well known quotes. Whilst risks are skewed to the downside, “things are never as bad as they seem” and then there is the old adage, “it’s not about timing the market, but time in the market”, which has proven true over the years. Therefore, whilst we remain cautiously positioned, we prefer to stay invested throughout the market cycle.

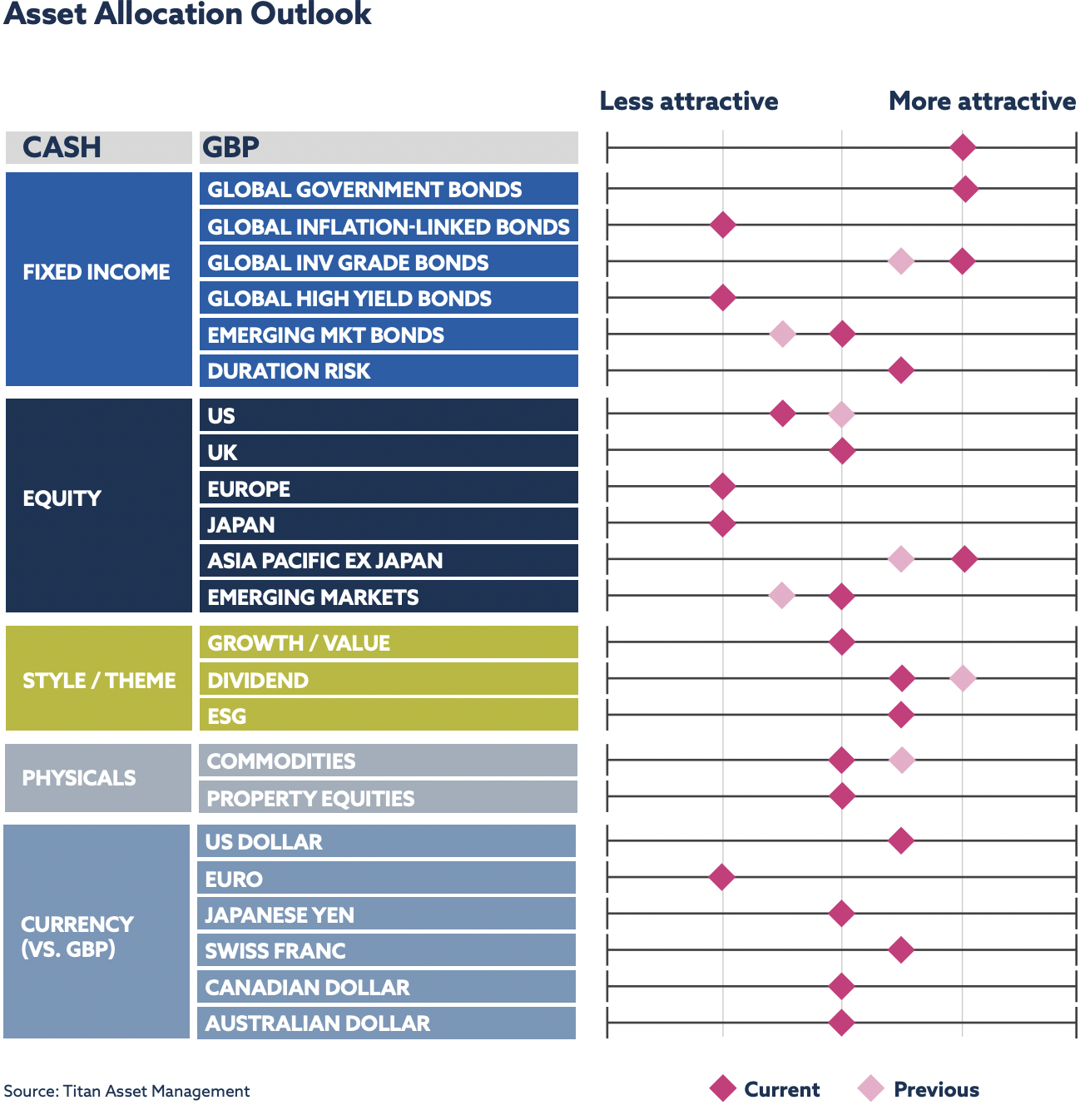

The key is to adapt the portfolio, to provide resilience, and allocate where the opportunities are. Cash now offers an attractive yield, as do bonds, which may come back in vogue later this year as inflation rolls over and the recessionary narrative picks-up place. Within the US we retain a preference for defensive sectors and quality companies with stable cashflows. Outside the US we like Asia given attractive valuations and relative economic growth forecasts. Let’s dive a little deeper.

Fixed Income

The Fed’s determination to bring down inflation will lead to a slowdown in the global economy, setting the scene for core fixed income to outperform riskier alternatives. We prefer nominals to inflation-linked government bonds and expect US Treasuries, German Bunds and UK gilts to prove resilient later this year. We also like Chinese government bonds which tend to outperform during periods of risk aversion.

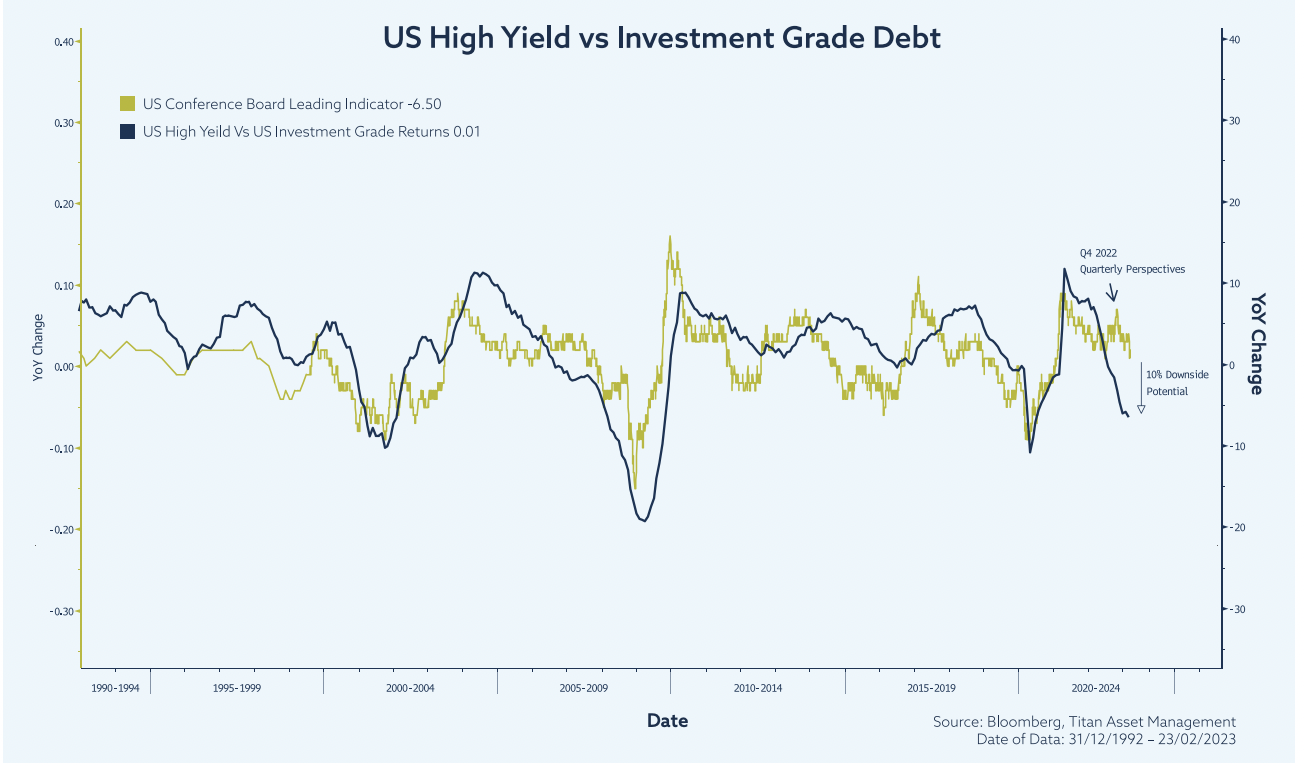

Within credit we continue to like investment grade versus high yield as credit risks pick-up over time, in marked contrast to the duration play that benefited the latter throughout 2022. High yield debt is not well priced for the gradual rise in debt servicing costs and the decline in forecast corporate earnings described in the key themes section.

Equities

Global equities posted gains in the last quarter of 2022 to round off what had been a turbulent year for the asset class. The MSCI All-Country World was up 9.88% in the fourth quarter but ended the year close to 18% lower, its worst year since 2008 as multi-decade high inflation forced central banks to tighten monetary policies globally in the face of a weakening economic backdrop.

2023 got off to a bright start with strong gains across equity markets as investors’ hopes for a “soft landing” grew on the back of moderating inflation prints and some slightly more positive economic data points. Among the leaders was the Nasdaq Composite which returned 10.73% in January, its best January performance since 2001 after suffering losses of over 32% last year. Global equities are still higher for the year but have been met with headwinds following banking woes in the US and Europe (we will be releasing a blog on this shortly).

We were hesitant to chase the risk-on rally in equities that kicked off the year as we believed the recent bout of equity optimism was overextended. The year-to-date rally has been led by some of the lower-quality parts of the market seemingly predicated on a shift in central banks’ policy stance which we were less convinced of and therefore maintained our defensive stance.

Corporate profit margins have been declining but remain above pre-pandemic levels which may not be sustainable going forward. The majority of S&P 500 sectors’ year-on-year earnings growth was negative with the proportion of earnings misses above five and ten-year averages. Forward guidance has also been less compelling which we believe the market is still not pricing in with the recent market re-rating led by bank stocks.

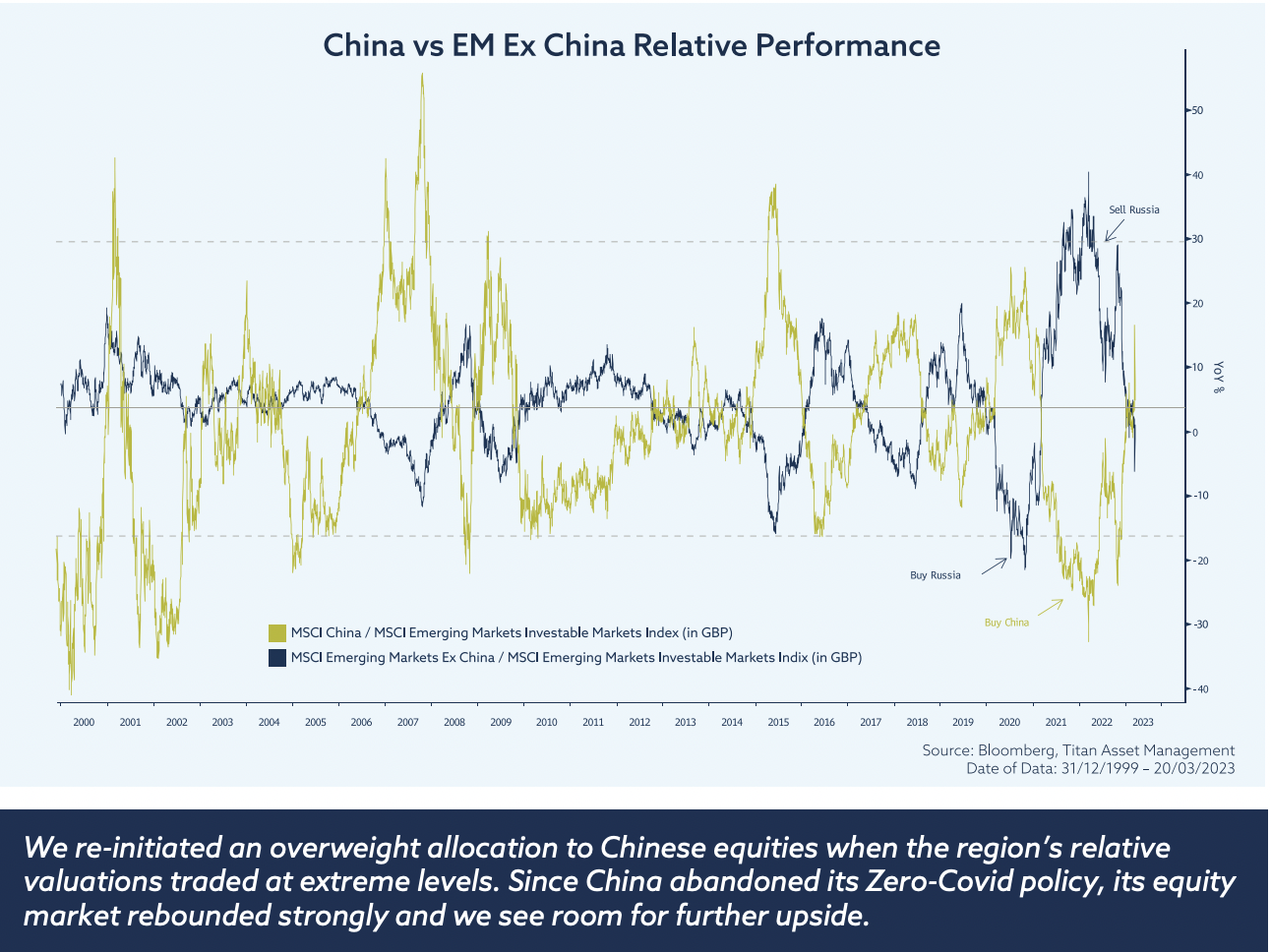

Our conviction in Chinese equities remains in place as China’s economic reopening gets underway with the high-frequency data pointing to a recovery in consumption. The People’s Bank of China is estimated to have injected $450 billion of liquidity throughout December and January which has bolstered equity returns in the region. They have reiterated their intentions to boost domestic demand which should be a tailwind for their equity market.

Neighbouring Asian countries should also set to benefit from China’s reopening and are likely to be a bright spot in the global economy for the year ahead with some Asian markets also trading at attractive valuations.

Physicals

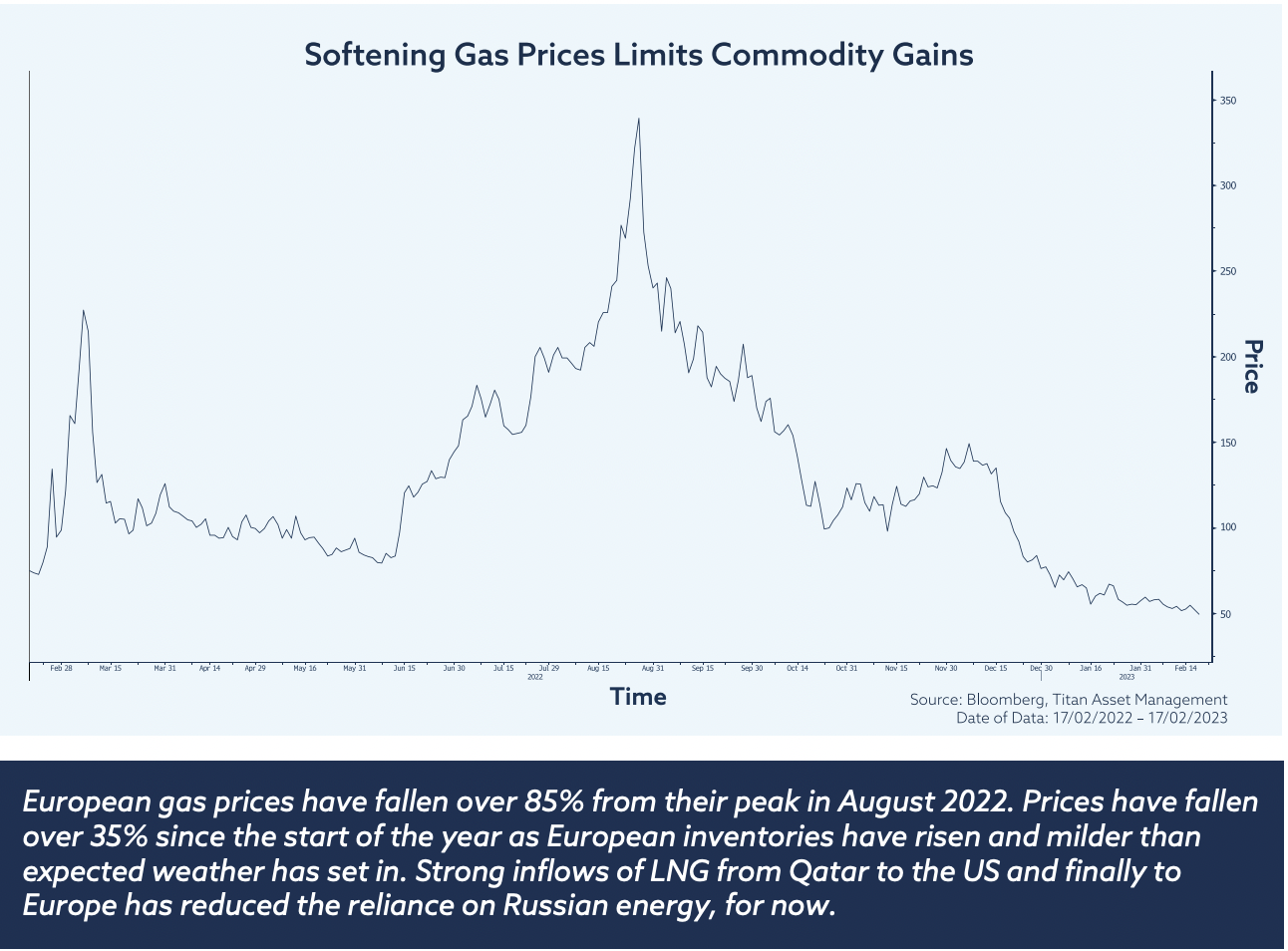

Commodities have lagged rampant equity markets so far this year, unable to keep pace with waves of positive sentiment driven by rhetoric of cooling inflationary pressures and softening central bank stances. Despite more recent volatility in markets, commodities have subsequently failed to recover this performance. Geo-politically little has changed in energy markets, with the most notable development a production cut proposed by Russia.

Whilst downplayed by EU policymakers, a 500,000 BDP cut roiled markets with brent crude climbing by 8.1% in early February. However this reaction leaves oil prices almost unchanged for the year, erasing only January losses. Elsewhere, a broad-based basket of commodities would have underperformed MSCI world by approximately 9% since the new year. This has been driven by milder weather softening global gas prices, leading to elevated inventory levels and demand weakness.

Until recently, subdued Chinese demand has capped any commodity gains, although this narrative may be beginning to shift. We sold our position in a broad-based commodity ETF across the Acumen portfolios in late 2022, crystalising over 40% relative profit vs MSCI world (priced in GBP). Across the ACUMEN Portfolios we retain exposure to an ETF targeting the global transition towards lower carbon sources of energy.

We continue to like the more defensive elements of commodities, namely in physical gold and gold producing equities. Gold mining equities within the US, Canada and Australia boast healthy balance sheets, with streamlined operations and sustainably increasing free cash flow. Despite such a positive start to the year for equity and bond markets, we maintain conviction in protecting downside risk due to increasing uncertainty in data and the yet-to-be-felt lagged effect of previous tightening.

Property indices had a strong start to the year after struggling for much of 2022. Whilst this is encouraging, and fundamentals are beginning to align, we remain

focused on ascertaining central bank positioning before engaging. Any hawkish sentiment could spell further trouble for this asset class.

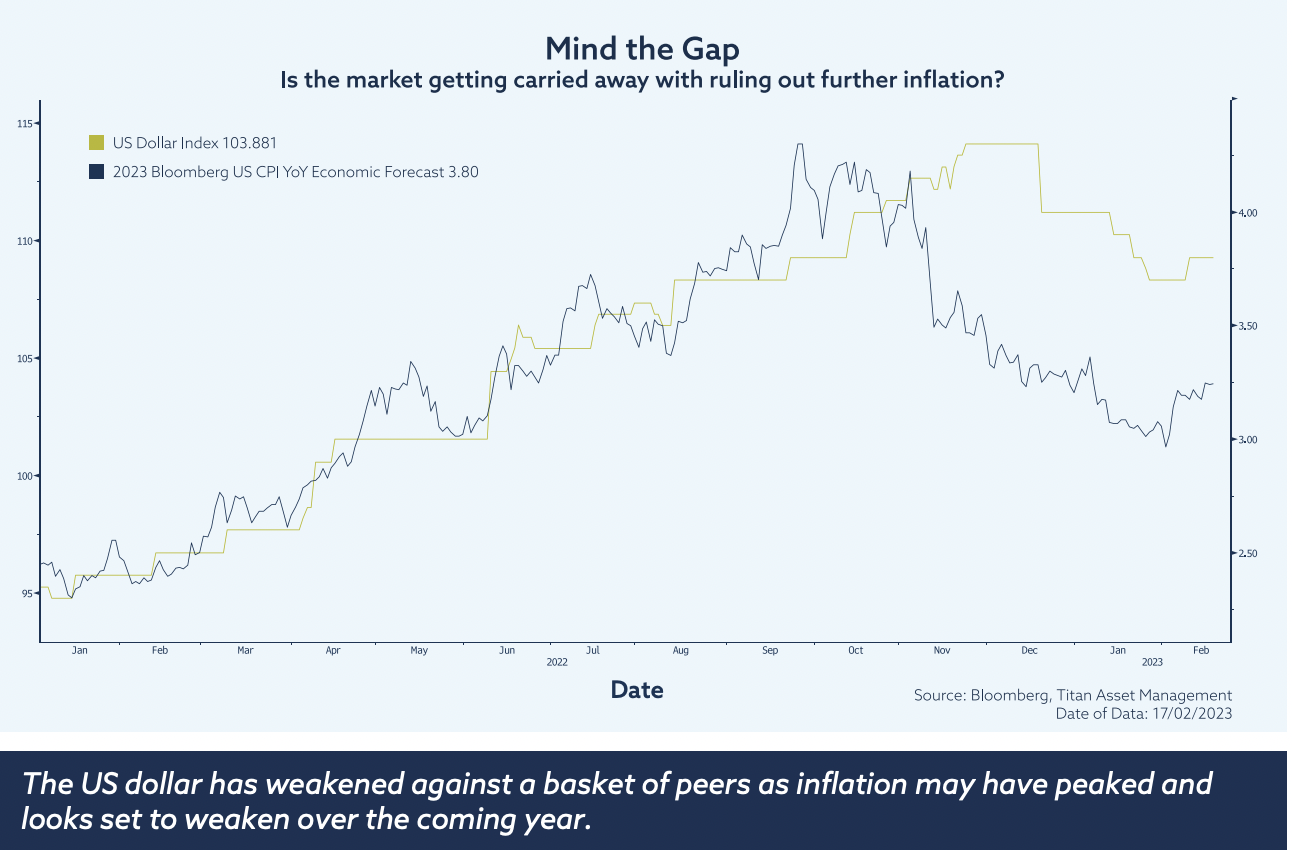

Foreign Exchange

Q4 of 2022 brought the toppling of the US dollar after what had otherwise been a very strong year for the currency. Previously, the Fed led the global charge in hiking interest rates to combat inflation. This resulted in the dollar appreciating against lower yielding currencies such as EUR and GBP as US Treasury yields rose and the comparative US growth outlook remained strong. Other central banks have since joined suit in hiking rates, including the ECB and the BOE, turning ever more hawkish on monetary policy to pump the brakes on otherwise runaway inflation.

Recently however, as inflation looks to have peaked, investors have grown tired of the Fed’s persistent ‘higher for longer’ narrative. This has been reflected in market pricing, as expectations for a shift in relative interest rate differentials led to a noticeable sell-off in the dollar. Meanwhile, GBP and EUR have been able to appreciate against the dollar in this disinflationary environment, spurred on by the recent revival in risk sentiment.

However, we see some risks to this narrative in the short term as risks skew toward inflation proving to be stickier (especially considering the recent tightness in the US labour market), changing risk sentiment and growing geopolitical tensions. Looking past these risks into the latter half of this year and 2024, we expect the US dollar will come under pressure as risk sentiment improves and interest rate differentials narrow.

Further afield, emerging market currencies and in particular the Chinese yuan has had a powerful surge as the economy continues to reopen. Risks to CNY strength will be important to bear in mind, as the PBOC will not want the currency strength to impede export competitiveness.

We have not meaningfully altered the currency exposure across the ACUMEN Portfolios but may look to do so over the coming year should we see meaningful change in the longer-term prospects for the dollar.

Final Thoughts

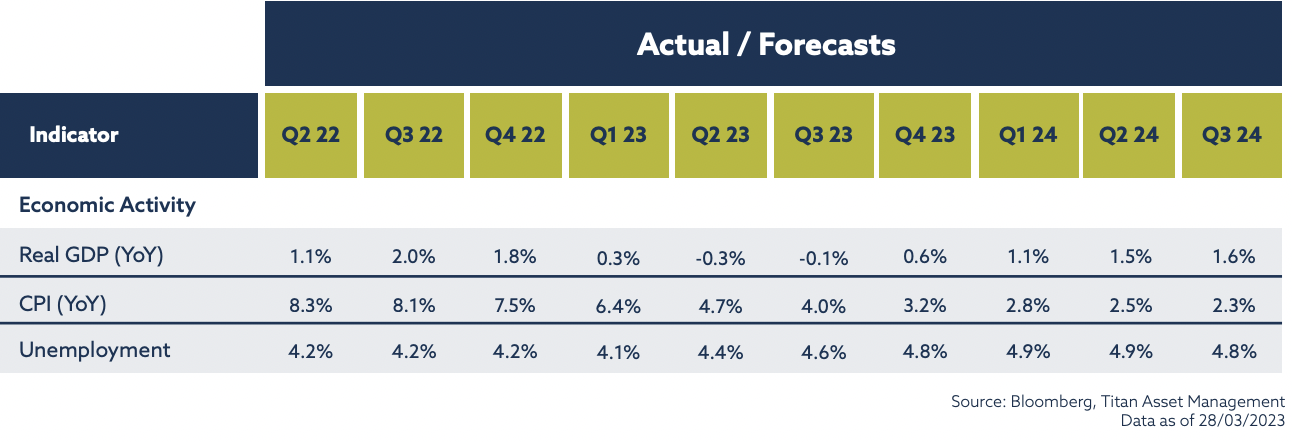

Bloomberg contributor composite expectations for G8 country real GDP points to a slowdown in economic activity later this year, including a notable drop in Q1 and two quarters of negative growth in Q2 and Q3. This points to the real and rising risk of recession before a subsequent resurgence in 2024. Our preferred way to play this theme is via defensive positioning across high quality assets. Regionally the most exciting opportunities exist outside the US, in Asia Pacific.

In such a scenario we also think increasing exposure to bonds, within a multi-asset portfolio, makes good sense. As shown in the chart below, bonds tend to outperform equities during recessions, demonstrated by the red bars. Since the coronavirus equities have held up remarkably well versus bonds and whilst that remains the case for now, those gains have stalled.

We are looking for a clear break of the long-term resistance line in yellow (now support), in place since the global financial crisis, as a clear signal for a meaningful rotation into bonds.

Our job is to adapt to markets as they evolve, to ensure we continue to provide attractive long-term growth opportunities to clients whilst also protecting client assets when the outlook proves more challenging. We think we are going through one of those periods where the outlook may be starting to change. You can read more about our approach to the market cycle and how we managed these risks, in our upcoming blog, ‘Technically Speaking’.