Our thoughts are with everyone impacted by the deeply saddening Russia-Ukraine conflict. We wish for peace, human rights and unity to prevail. Please note that since the conflict began, and consistent with our sanctions policy, we have no direct exposure to Russian assets across the ACUMEN Portfolios.

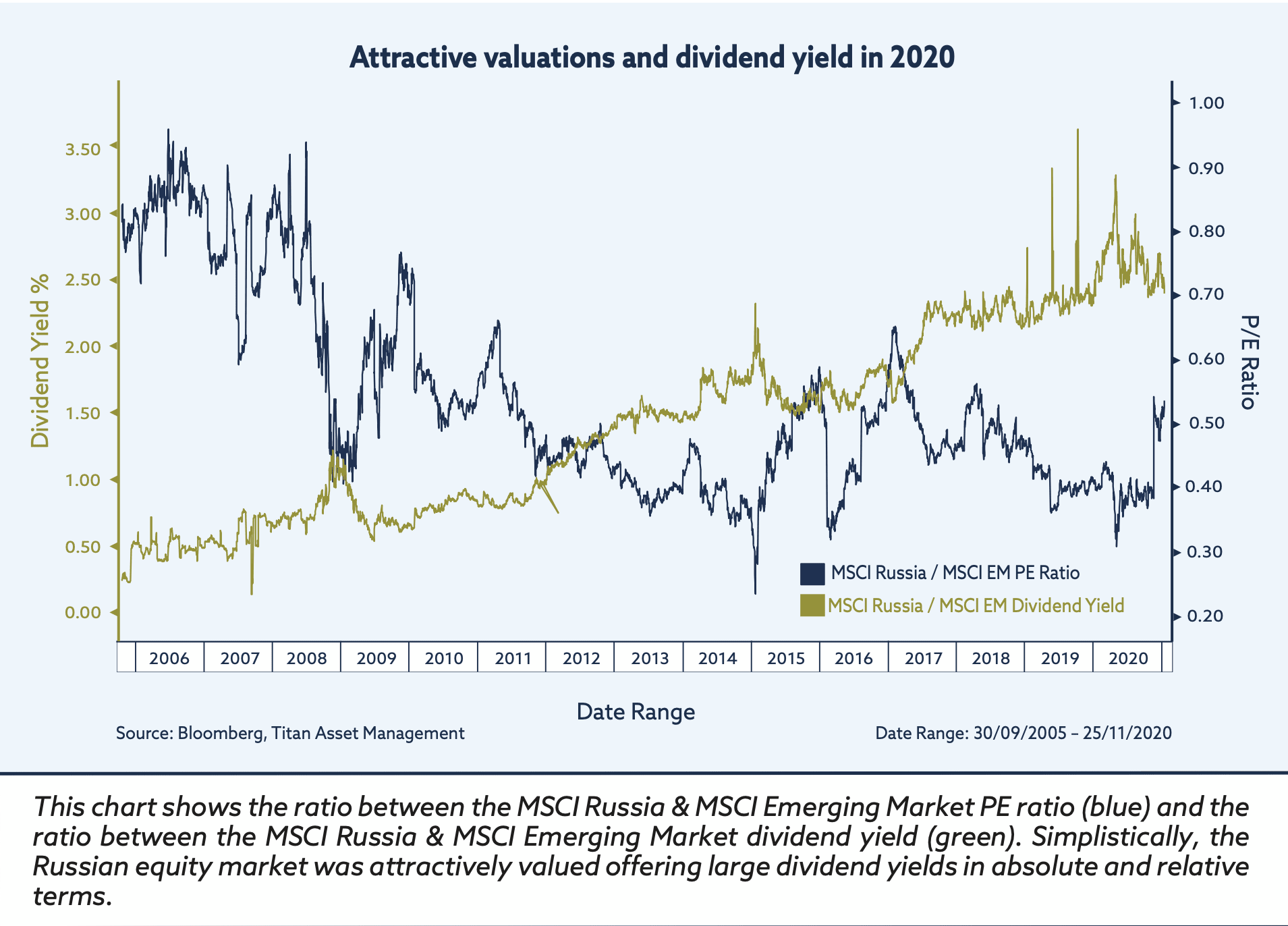

We opened a position in Russian equities in November 2020. The investment rationale at the time was in keeping with our reflation theme across the ACUMEN Portfolios which we had pivoted towards in the preceding months. The Russian equity market is among the most cyclically geared with over half its weighting in the energy sector, followed by financials and materials.

Equity multiples in the region were trading at a steep discount relative to long-term averages and other markets. Russia’s cheap valuations were coupled with healthy dividend yields making them particularly attractive on a total return basis. The currency had been under pressure but had supportive macroeconomic fundamentals as a tailwind with a current account surplus, a very low debt burden and strong fiscal discipline.

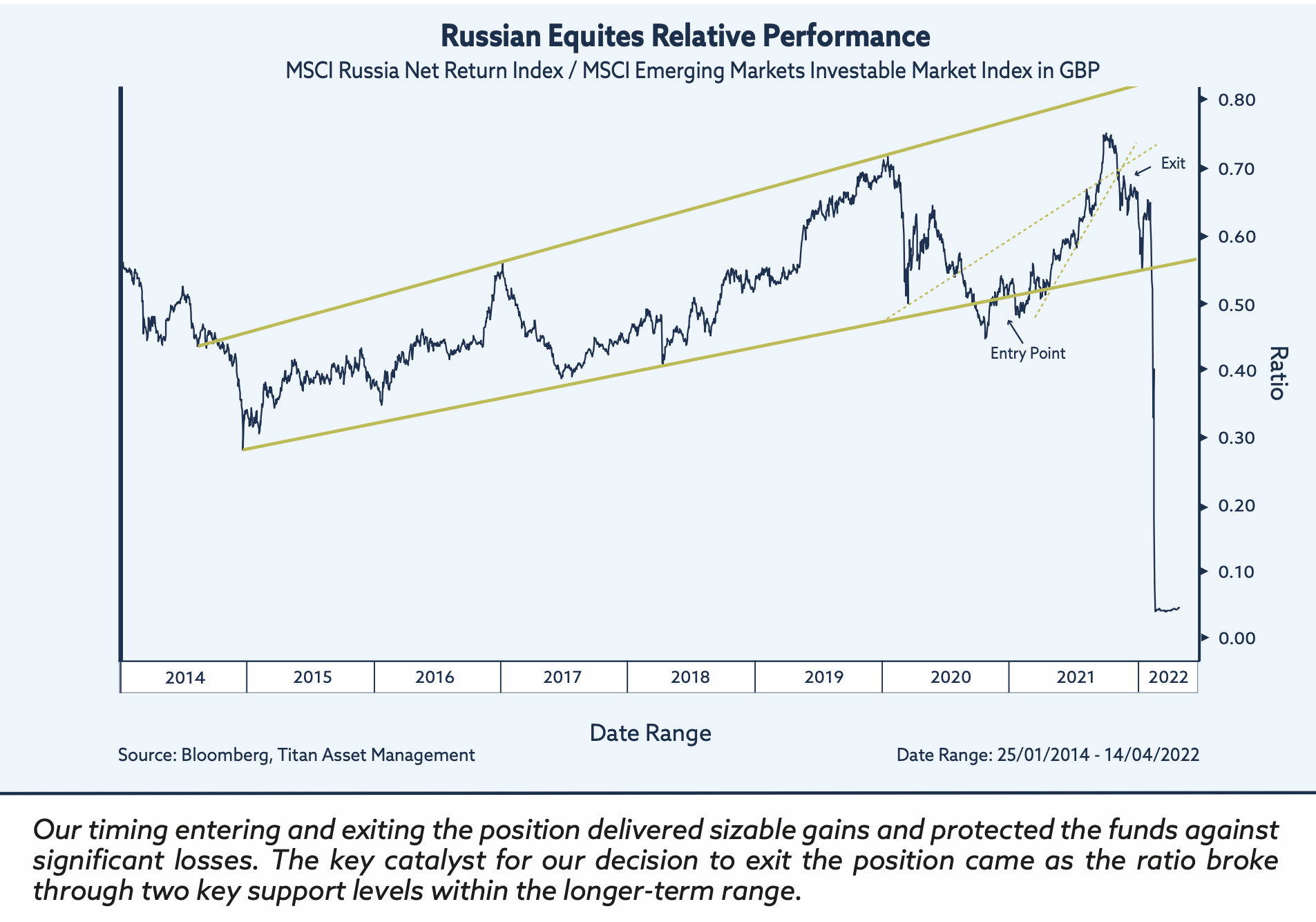

The fundamental case for the position was there but we also wanted to assess the price action through a technical lens. The MSCI Russia equity index, relative to the MSCI Emerging Markets, fell out of its six-year trading range in late 2020, so we set an alert for when it re-entered the range as a potential buy signal.

Similarly, we also looked for a bullish indicator on the currency, RUB/GBP, relative to the JP Morgan Emerging Market Currency Index. With the macroeconomic, fundamental and technical outlook all pointing in the same direction, we opened a position. Our investment thesis played out over the course of the year with Russian equities rallying ahead of its peer group. As part of our risk management, we set stop losses and take profits based on technical levels as well as daily volatility monitoring; any alerts would trigger a fundamental review of the position.

As November approached, the position came off its relative highs versus the MSCI EM. Geopolitical tensions rose as Russian troops built their presence on Ukrainian borders. While we by no means envisioned the devastating events that would unfold, we were cognisant of the rising geopolitical risks and real threat of sanctions.

We took profit on the position exactly one year and one day after entering it as we believed the risk-adjusted return potential had shifted to the downside. A profit of just under 30% was booked in absolute terms and approximately 25% relative to the broad emerging market benchmark.